IL DoR PTAX-203-A 1999-2024 free printable template

Show details

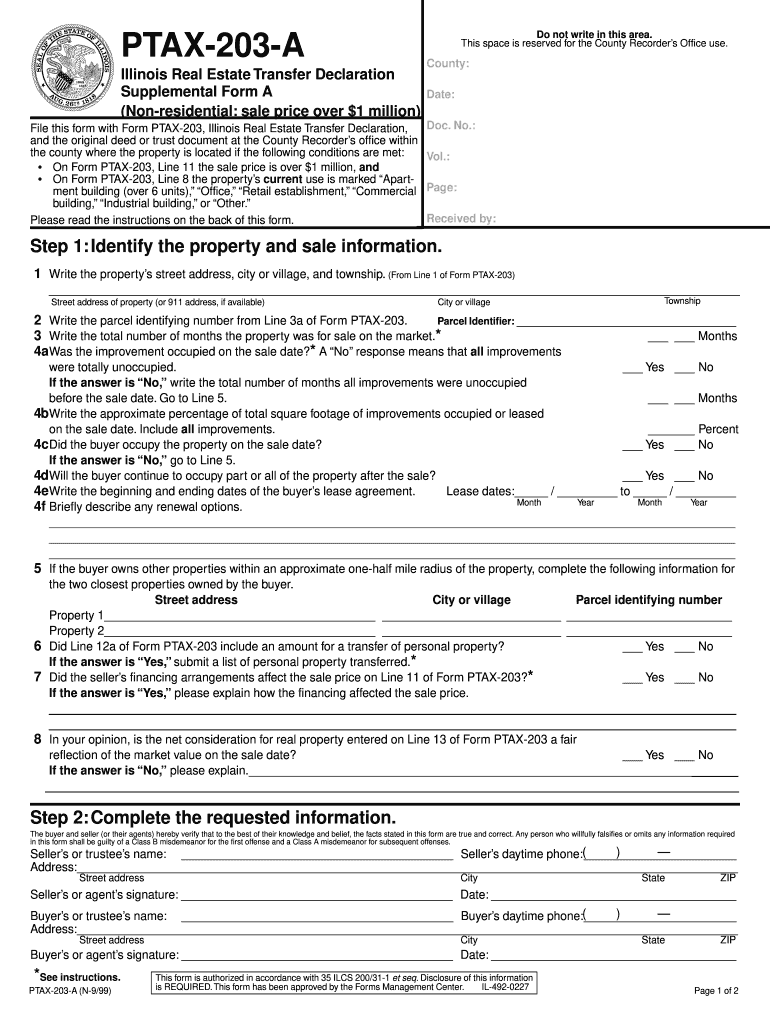

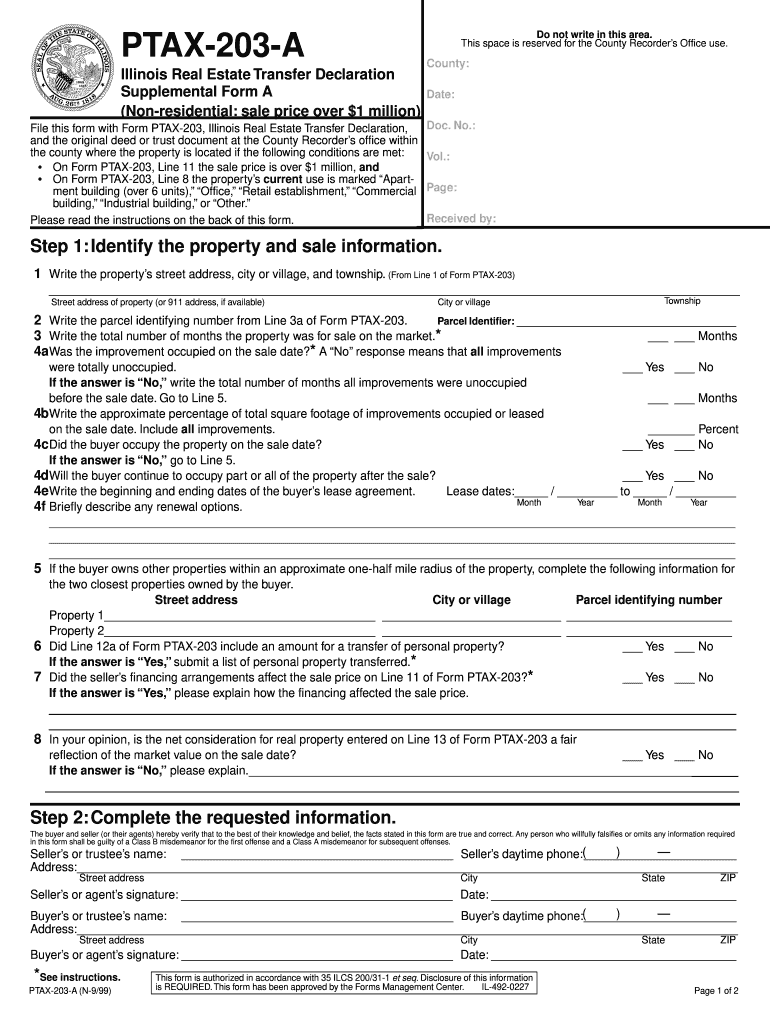

PTAX-203-A Illinois Real Estate Transfer Declaration Supplemental Form A Non-residential sale price over 1 million File this form with Form PTAX-203 Illinois Real Estate Transfer Declaration and the original deed or trust document at the County Recorder s office within the county where the property is located if the following conditions are met On Form PTAX-203 Line 11 the sale price is over 1 million and building Industrial building or Other. Please read the instructions on the back of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your illinois ptax 203 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois ptax 203 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit illinois ptax 203 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ptax 203 a form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out illinois ptax 203 form

How to fill out tax exemption:

01

Gather all necessary documents such as W-4 or W-9 forms, proof of income, and any applicable tax forms.

02

Review the eligibility requirements for tax exemption to ensure you qualify for this benefit. Consult with a tax professional if needed.

03

Complete all sections of the tax exemption form accurately, providing all requested information including your personal details, income information, and any other relevant details required.

04

Attach any supporting documents required to validate your eligibility for tax exemption, such as proof of your nonprofit status or disability certification.

05

Carefully review and double-check all the information provided on the tax exemption form to avoid any errors.

06

Submit the completed and signed tax exemption form along with any required supporting documentation to the appropriate tax authority by the specified deadline.

Who needs tax exemption:

01

Individuals or businesses engaged in qualifying nonprofit activities may need tax exemption to claim deductions or exclude certain income from their tax liabilities.

02

Some individuals with specific circumstances, such as disabled individuals or those facing financial hardships, might need tax exemption to alleviate their tax burden or qualify for certain tax credits.

03

Certain organizations and charities that meet specific criteria may require tax exemption to ensure they are not subject to paying taxes on their income.

Note: It is always recommended to consult with a tax professional or seek advice from the appropriate tax authority for accurate and up-to-date information regarding tax exemptions and eligibility requirements.

Video instructions and help with filling out and completing illinois ptax 203

Instructions and Help about property exempt tax form

Fill sales tax exemption : Try Risk Free

People Also Ask about illinois ptax 203

What is form 1023 or 1024?

How do I get tax exemption?

What is the tax exempt form for NYS?

What is an example of a tax exemption?

What is a tax exemption?

Is it better to claim 1 exemption or 0?

Who is exempted from income tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax exemption?

Tax exemption is a tax status granted to an individual or organization that is exempt from paying certain taxes. This exemption may be partial or complete, depending on the specific laws of the jurisdiction, and it can apply to income, property, sales, and other types of taxes. Tax-exempt status typically requires the individual or organization to be engaged in activities that are beneficial to society, such as charitable, educational, or religious activities.

What is the purpose of tax exemption?

Tax exemption is a government incentive that reduces taxable income for certain individuals or organizations. It is used to encourage activities that benefit society, such as charitable giving, home ownership, and investment in certain industries. Tax exemptions are one of the primary tools used by governments to promote certain economic activities and to reduce the burden of taxation on individuals and businesses.

What information must be reported on tax exemption?

When filing for tax-exempt status, the following information must be reported: the organization’s name and address, federal tax identification number (EIN), type of organization (e.g. nonprofit corporation or trust), purpose of organization, date of formation, list of officers or trustees, list of members or directors, source of income, and copies of any documents filed with the state or federal government.

When is the deadline to file tax exemption in 2023?

The deadline to file tax exemption in 2023 will depend on the specific type of exemption. Generally, most tax exemptions are due on April 15 of the year the exemption is claimed.

Who is required to file tax exemption?

The individuals or organizations required to file tax exemption typically include:

1. Non-profit organizations: These include charities, religious organizations, educational institutions, and other non-profit entities that qualify under the tax laws for exemptions.

2. Certain business entities: Depending on their structure and type, some business entities may qualify for tax exemptions, such as certain cooperative corporations or social clubs.

3. Individuals with specific exemptions: Certain individuals may be eligible for tax exemptions based on certain criteria, such as senior citizens, disabled individuals, or veterans, among others. These exemptions vary by country and jurisdiction.

It is important to note that the specific rules and eligibility criteria for tax exemption vary by country and jurisdiction, so it is advisable to consult the relevant tax authorities or a tax professional for accurate and up-to-date information.

How to fill out tax exemption?

To fill out a tax exemption form, follow these steps:

1. Obtain the appropriate tax exemption form: Find out which tax exemption form you need to complete. This could be determined by the type of exemption you qualify for (e.g., religious, nonprofit organization), the type of tax (e.g., sales tax, property tax) or the specific government agency responsible for the tax.

2. Provide personal information: Fill in your personal details, such as your name, address, Social Security number, and any other identification information required by the form.

3. Describe the exemption: Clearly state the reason for your tax exemption. This could involve describing your religious affiliation, nonprofit status, or any other qualifying criteria as specified by the form.

4. Attach supporting documents: Depending on the nature of the exemption, you may need to attach supporting documentation to prove your eligibility. This can include copies of your organization's articles of incorporation, proof of religious affiliation, or any other relevant documentation specified by the taxing authority.

5. Complete any additional sections: Some tax exemption forms may have additional sections that require specific information or signatures. Make sure to fill out these sections as required.

6. Review and submit the form: Once you have completed the form, carefully review all the information provided to ensure accuracy and completeness. Incorrect or missing information can lead to delays or denials. Sign the form, if required, and submit it to the appropriate tax authority by the provided deadline.

It's worth noting that the specific steps and requirements for filling out a tax exemption form may vary depending on your jurisdiction and the type of exemption. Consulting with a tax professional or the relevant tax authority can provide you with more specific guidance tailored to your situation.

What is the penalty for the late filing of tax exemption?

The penalty for the late filing of tax exemption can vary depending on the specific tax laws and regulations of a particular country. Generally, late filing penalties may include:

1. Late filing fee: This is a fixed amount or a percentage of the tax-exempt amount that is added to the total tax due as a penalty for late submission.

2. Interest charges: Late submission of tax exemption may result in the application of interest charges on the unpaid tax amount. The interest rate is typically determined by the tax authority and may accumulate daily until the amount is paid.

3. Loss of benefits or deductions: In some cases, filing tax exemption after the due date may result in the loss of certain benefits or deductions that could have been claimed if the exemption was filed on time.

It is important to consult the specific tax laws and regulations of your country to determine the exact penalties for late filing of tax exemption.

How do I fill out illinois ptax 203 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ptax 203 a form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit illinois form ptax 203 a on an Android device?

You can edit, sign, and distribute tax exemption on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out illinois ptax 203 a on an Android device?

On Android, use the pdfFiller mobile app to finish your exempt tax exemption form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your illinois ptax 203 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Form Ptax 203 A is not the form you're looking for?Search for another form here.

Keywords relevant to form ptax 203 a

Related to ptax 203a

If you believe that this page should be taken down, please follow our DMCA take down process

here

.