IL DoR PTAX-203-A 1999-2026 free printable template

Show details

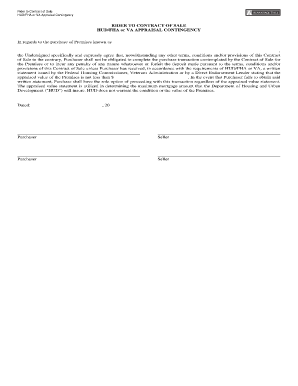

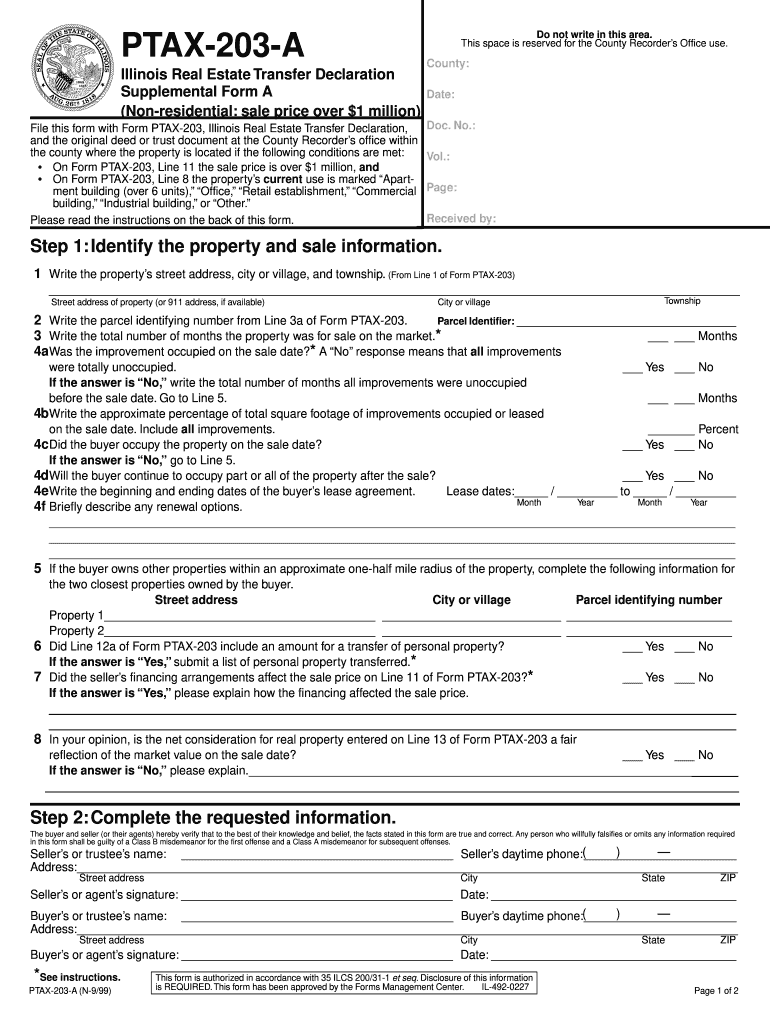

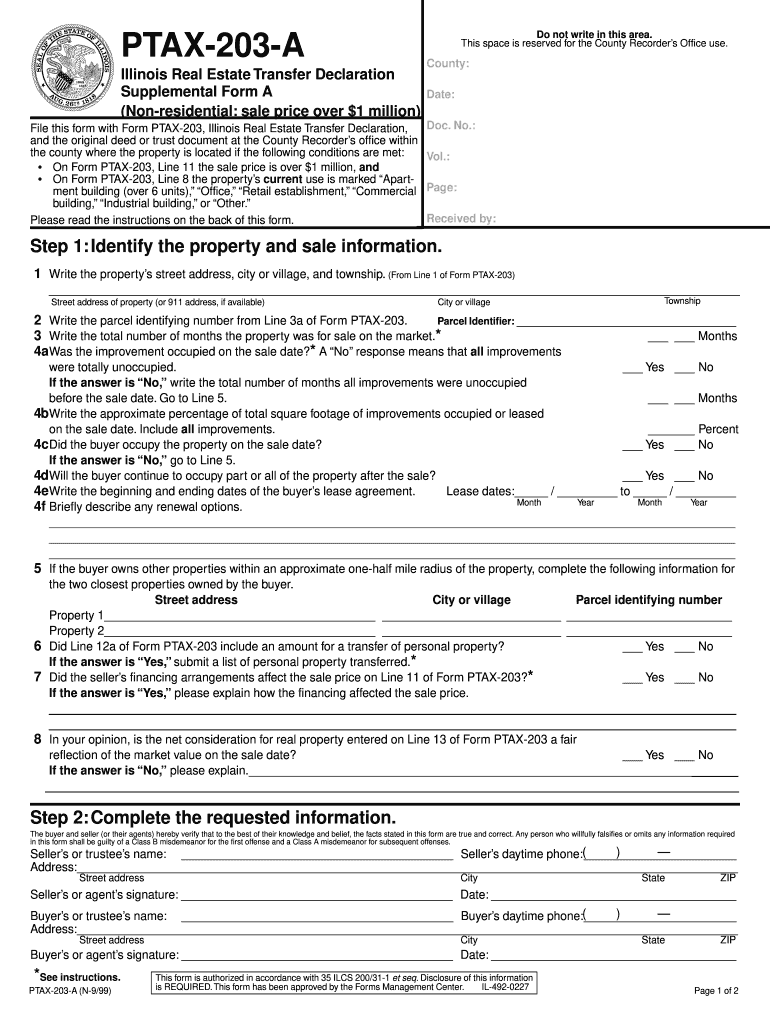

PTAX-203-A Illinois Real Estate Transfer Declaration Supplemental Form A Non-residential sale price over 1 million File this form with Form PTAX-203 Illinois Real Estate Transfer Declaration and the original deed or trust document at the County Recorder s office within the county where the property is located if the following conditions are met On Form PTAX-203 Line 11 the sale price is over 1 million and building Industrial building or Other. Please read the instructions on the back of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ptax 203 form

Edit your ptax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ptax 203a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ptax illinois online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how to fill out il related to veterans or seniors form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ptax form illinois

How to fill out IL DoR PTAX-203-A

01

Obtain the IL DoR PTAX-203-A form from the Illinois Department of Revenue website.

02

Start by filling in your name and address in the designated fields.

03

Provide the property identification number (PIN) of the property for which you are applying.

04

Indicate the type of exemption you are applying for by checking the appropriate box.

05

Fill out any required property details, such as the property’s legal description and parcel number.

06

Provide information about your income and any other required financial details.

07

Attach any necessary documentation to support your application, such as proof of income or ownership.

08

Review your form for accuracy and completeness.

09

Sign and date the form at the bottom.

10

Submit the completed form to your local assessment office by the given deadline.

Who needs IL DoR PTAX-203-A?

01

Illinois property owners seeking a property tax exemption.

02

Individuals claiming a general homestead exemption.

03

Residents applying for property tax exemptions related to veterans or seniors.

Fill

ptax 203 illinois

: Try Risk Free

People Also Ask about illinois ptax 203

What is form 1023 or 1024?

Form 1023 is used to apply for 501(c)(3) status, while Form 1024 is used to apply for another type of federal exemption, such as 501(c)(4) or 501(c)(6).

How do I get tax exemption?

Tax exemptions can be availed by investing in the following tools: Senior Citizen Savings Scheme (SCSS) Sukanya Samriddhi Yojana (SSY) National Pension Scheme (NPS) Public Provident Fund (PPF) National Pension Scheme (NPS)

What is the tax exempt form for NYS?

To make tax exempt purchases: Complete Form ST-119.1 (This form is mailed with your exemption certificate, and is not available on our Web site. To get additional copies of this form, contact our sales tax information center.)

What is an example of a tax exemption?

What Is a Tax Exemption? A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

What is a tax exemption?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

Is it better to claim 1 exemption or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Who is exempted from income tax?

Retirement Compensation from a Public Sector Company or any other Company [Section 10(10C)] Tax on Non-monetary Perquisites paid by Employer [Section 10(10CC)] Amount received under a Life Insurance Policy [Section 10(10D)] Statutory Provident Fund [Section 10(11)]

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out illinois ptax using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign illinois ptax form online and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit ptax 203 on an Android device?

You can edit, sign, and distribute form ptax 203 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out what is a ptax form on an Android device?

On Android, use the pdfFiller mobile app to finish your il ptax form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IL DoR PTAX-203-A?

IL DoR PTAX-203-A is a form used in Illinois to report the exemption of a property from property taxes, specifically for certain tax exemption claims like those for senior citizens, disabled persons, or specific types of property.

Who is required to file IL DoR PTAX-203-A?

Individuals or entities claiming an exemption on real property taxes in Illinois are required to file IL DoR PTAX-203-A, particularly when applying for the General Homestead Exemption or related exemptions.

How to fill out IL DoR PTAX-203-A?

To fill out IL DoR PTAX-203-A, you need to provide property identification information, your contact details, the type of exemption being claimed, and any required documentation supporting your claim.

What is the purpose of IL DoR PTAX-203-A?

The purpose of IL DoR PTAX-203-A is to allow property owners to formally apply for and claim exemptions from property taxes to potentially reduce their tax burden.

What information must be reported on IL DoR PTAX-203-A?

The form requires reporting information such as the property identification number, the owner’s name and address, the specific exemption sought, and any supporting details regarding eligibility for the exemption.

Fill out your IL DoR PTAX-203-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Ptax 203 Form is not the form you're looking for?Search for another form here.

Keywords relevant to ptax 203 form illinois

Related to ptax203

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.